Happy Hump Day PFL! I’m here again with Kim’s September Sapphire Even Day Blog Challenge!

Today’s prompt – Impingement: Which book and/or movie has affected you like no other? How? Why?

There are several books and movies that have influenced me. Since I mentioned to you in 20 Influential Women in a tweet that Lynnette Khalfani-Cox was one of the virtual mentors I followed, I chose one of her books that I read after graduating from school.

The Money Coach’s Guide to YOUR FIRST MILLION – Lynnette Khalfani

Apparently, everyday in the United Stated 25K people become millionaires! Most of them use budgets to get there!

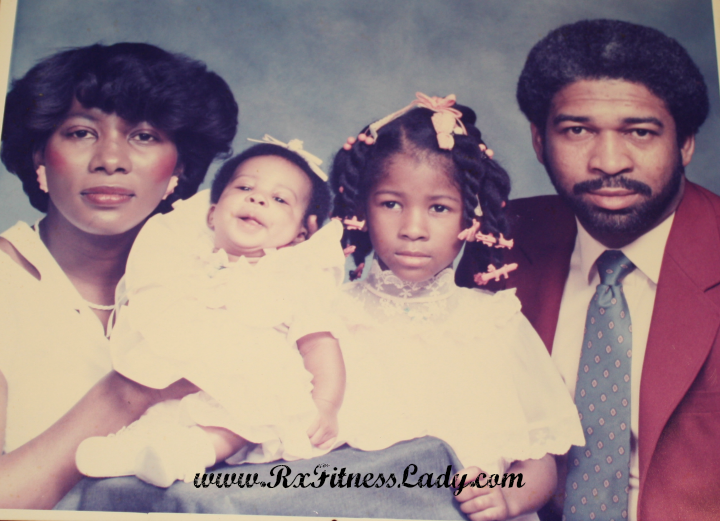

I’ve had a knack for financial management since I was a little girl. I was forever making deals with my Dad, to get more money out of him by saving my allowance to purchase different items.

Ok, so maybe I wasn’t hustling this early, but I thought you all might get a snicker out of that picture 😉

Daddy got a kick out of my early hustle game and I learned a lot. As an adult I turned to several authors upon graduating so as not to get overwhelmed going from school girl to career woman!

I did a pretty good job and have hosted a financial boot camp before for my girls! I used several reading material to put the camp together and this was one of the books!

I thrive off of learning from other people! That’s one of the reasons I love blogging. We all get to share our areas of expertise or experience and hopefully help someone along the way. Here are some thoughts not necessarily originally from Khalfani-Cox, but things to ponder on or that you will glean from after reading this book!

- Learn why millionaires love BUDGETS & how they use them to get richer

- Learn your money personality

- If you don’t already have one or know what one is, you’ll be inspired to properly fund an Emergency fund

- Clear up questions about being insured properly

- You will know your credit score or where to find it

- Be inspired to share your financial goals, short-term, & long-term goals with your significant other

- You will have a plan B & at least touch the surface of investing properly

- You will know what to do with a windfall (A sudden, unexpected piece of good fortune or personal gain)

- How to deal with family members/friends that are financial drainers!

- You will be sure to prepare for the next generation

- Preparation for the Dreaded D’s : Downsizing, divorce, disability, disease or death in the family, and disaster

I just touched on why I think this book is worth a read! Did any of that spark any interest for you? I know for a 24 year old fresh out of pharmacy school, my list after reading this book was pretty long.

My biggest takeaway from this book was the creation of my financial policy statement that goes along with my budget. I live by it! Here is an exert that you might possibly identify with!

I will not; go shopping just because I receive coupons (Macys/Cache/etc.)

🙂 That line is kind of funny, but was a serious issue for me back in 2006! My statement is about 15 sentences and it’s way more serious than my coupon problem! I think it is a vital piece of information to have for yourself in this world where keeping up with the Jones’ can be very tempting…no pun intended 😉 !

Remember Monday in “Allow Me to reintroduce Myself” when I said a lady should be able to handle her business I meant that literally! Here are some more that helped me do so financially!

Honorable Mentions

- Rich Dad’s Cashflow Quadrant – By Robert T. Kiyosaki with Sharon L. Lechter, C.P.A.

- Rich Dad Poor Dad By Robert T. Kiyosaki

Rx Fitness Lady wants to know…

- Do you use ‘four letter words” 🙂 ?

- Are you enticed by coupons?

- What movie has affected you the most?

- Are you budget friendly or adverse?

- Parents: what’s the going rate for allowance these days?

Rx Fitness Lady

Latest posts by Rx Fitness Lady (see all)

- In The Paint Student Spotlight #9 – On Demand Fitness Princess - October 26, 2021

- How Does Exercise Fit Into Breast Cancer Awareness Month - October 4, 2021

- In The Paint Student Spotlight #8 – Accountability at its Finest - September 26, 2021

Super interesting! I am going to check that book out! 🙂 My dad is very financially savvy and has always tried to encourage me to be the same way.-Ashley

thedoseofreality recently posted…Would You Rather: Sit Next To A Gum Snapper Or An Ice Cruncher?

It’s awesome to have a head of household that is in tune with finances…at least it was for me! Thanks Ashley!

That pic is sooo cute! Why is no one smiling? Your mom looks so distinguished and poised. Love it!

Anywhoo, I love this post. I wonder if there’s an e-book. I gotta check it out. Those are some really awesome tips. It’s a credit to you being financially responsible and savvy…having a financial policy statement graduating from college…that’s awesome. I had to learn the hard way. I’ve written (a chapter on my one day hard cover book) how I managed to go from a 350 credit score to 805. (maybe I should transfer some of the info into a blog). Budgeting was a huge part of the journey.

It’s so awesome to start out right. I know you’ll soon be one of the 25K becoming a millionaire.

Hope recently posted…My Disney World Highlights

Thanks for the confidence my friend 🙂 I can’t wait to read your book! That credit score change is some testimony, definitely would be helpful to someone. Get that in print ASAP boo!

I am not sure what was going on in that picture with Mother. That’s typical for me and daddy but my mother is always all smiles 🙂

I actually am somewhere in between. I don’t do the coupon thing but there is an Ann Taylor around me that gets me weak in the knees whenever there is a 50% sale! 🙂 these are some great tips. I think I might pick this book up. You are all so adorable in that picture!!

I hear you re: Ann Taylor, Nelle. I do penance afterwards!

Thanks Nellie, I like the picture… no smiles and all!

50% will get me too! The book is excellent, hope you will give it a shot!

Sounds like a fascinating read! Thanks for sharing.

I LOVE your family picture! So darn cute!!!

Wishing you a lovely day.

xoxo

Jennifer | The Deliberate Mom recently posted…Back To Homeschool

Thanks Jennifer.. a little throwback on the blog for the day 🙂

I was a broke single mom with 2 kids back in the day. All of my financial lessons came from the school of hard knocks. No one in my family took the time to sit down and talk to me about money (or boys or sex or any other important life stuff). Sooooo, I’m glad you’re creating awareness about this today. My finances have since been healed and doing well for quite some time now, but those were very hard times to navigate through and learn from back then. My favorite “financial” book is the bible. God’s wisdom about financial stewardship is second to none.

Yum Yucky recently posted…2 Non GMO Foods I’m in Love With

So much good stuff!

The school of hard knocks is the best teacher and I hope that you use those lessons to share with others. It is received best sometimes from people who have been there.

The bible is for sure how we should all be operating. You get no argument from me with that!

I think that because we had very little when I was growing up I made some poor choices with spending when I was on my own. Now (thanks to following a budget), Chris and I live debt free (other than our mortgage which we will have for a few more years) and it is truly a great feeling. (We worked toward that goal for 15 years!!)

Kim recently posted…Self-Doubt

Awesome testimony Kim! You should write about that one day!

Amen!!! Being financially responsible is key! Tithe, savings, bills theeeeeeeeen fun. Tighten up the purse strings and live within your means. It’s scary how many people are trying to live the “American Dream” and going into debt doing so.

Thanky you for the book recommendations.

YES, I can always count on my boo to keep it on the church tip! Tithe first over everything!!!

Illusions by Richard Bach and Das Energi by Paul Williams were by far the most life changing books for me.

When I was deciding whether or not I should go to med school, I asked Das Energi by just opening it to a random page the first time I ever held that book. There were only two words on that lucky page, “Do it!” True story!

Dr. J recently posted…Eating Junk Food Can Decrease Performance

I will check it out Dr. J! Thanks!

I love the photo! I might just have to pick up this book, because while my and husband and I are at a financially stable spot in our lives we have been seriously thinking about how to make our money work harder for us. Thanks for the insight.

Aren’t we all. I think it will help with that too. I hope you will mark it on your to read list!

I am on the fence about coupons right now. I used to be one of those people that always forgot coupons and didn’t shop sales, but now I make a conscious effort to shop only when I have coupons. I am also trying to build up my wardrobe so I am really making myself shop more. Lol. (Yes….it is so hard!)

I used to work in finance years ago, so I love books on building financial freedom.

Kimberly {Manifest Yourself} recently posted…Journey to Wellness 9.4

You have to stay fresh for that dream job! I’m not mad at that! What did you do in finance?

Sure. (It’s a four letter word in response to your question).

I feel like people don’t prepare enough for the 4 Ds. When we bought our house we qualified for a l I an that was close to 300K. Of course our realtorcwas showing us these gorgeous houses in that price range. After the second one we explained that we would never spend that type of money. We like to operate as if we are a 1 income household not 2. Because we did that, we are able to keep our house now that Jason is unable to work. It’s hard to think of these things when you’re young sometimes.

Totally agree with the coupon comment! Loved this post!

Carla recently posted…The 12 Step Program to Health

AMEN! More people should think in terms of the 1 income operation…in my opinion anyway. Anything can happen to eliminate 1 income and it’s much easier to transition if your aren’t dependent totally on both! Thanks for that Carli!

I used to be really hard core about sticking to a budget; I’ve sort of fallen off the wagon. 🙁 I am making amends, however! I’m doing Suze Orman’s financial planning program so she’s whipping my butt into financial shape.

Super awesome! I love Suze Orman! She was on that list of 20 Influential Women as well!

Hey Joi! Let me start by saying you are your daddy’s daughter…the eyes say it all, lol! Love your list Joi! I must find that book(my husband may actually already have it). He reads two to three books at a time…IKR! We do have “Rich Dad, Poor Dad”….you’re right, it’s a great read. Thanks for sharing…financial freedom is something we all should desire! Working full-time in ministry, my family and I have gone the “unconventional” way. We’ve lived and prospered by doing it God’s way. Our motto in this season…”owe no man anything”. A book/movie that inspired me? “The Joy Luck Club” by Amy Tan. The most important lesson I learned from the book….”TO KNOW YOUR WORTH”, if you don’t…no one else will! As always Joi…thanks for sharing and thanks for linking up my friend! 😉

Michell recently posted…Doing YOU WELL Wednesday #31

Thanks for the share. I will add that to the list! I am just like the hubs. I can be reading 2 or 3 at time easily.

Girl, I said a four-letter word when I read your sentence about 25K people in the U.S. becoming millionaires daily. What?! Thankfully my husband has been working as a financial advisor for the last year, because that is not my thing (I’m budget adverse). Something he has always wanted to do and he is great with money. His mother instilled that in him as a teenager. BTW that serious look on your face in the old school picture is priceless. You look like you’re thinking, “Would you hurry up and take this picture, because I have things to do?!” Thank you for sharing such quality content.

Kimberly H. Smith recently posted…Perception Is Reality

I was kinda alarmed by that statistic too Kim! I’m just awaiting the day when one of those US lucky citizens 🙂

Love the throwback pic of your family!!! Priceless!! The hubs and I were just talking about creating a budget again…the last time we had one was before kids! It’s time. Thanks for the recommendation!!

Allie recently posted…RACE TRADITION

Sure thing Allie! I would go slap crazy if I had twins! I’d be seriously killing the shopping malls & internet. I’d need a very strict budget!

I absolutely love the old photo!

I am the budget-maker in my household. If my fiance had his way, we’d be in trouble! He’s one of those “it’s in the account, spend it!” kind of people. It gives me anxiety!

ROTFL Amy, he would give me anxiety too but you gotta love him…too funny!

OMG! I had such a coupon issue, that it began to drive those around me nuts. It is still very difficult for me to resist a good coupon and a great sale. I use to go and buy a pair of shoes every Sunday after church, because I felt like I deserved it…and most likely had a coupon. I am very savvy when it comes to budgeting and I had to kill those issues and put my future into perspective…the right perspective. Good post!

xoxo,

Carica

Carica recently posted…Mom, I’m just like you. I’m the only black person

I’m laughing at the whole after church thing. I feel you girl. We went shopping in pharmacy school on Fridays bc we felt we made it through the week! Crazy but when I actually became a pharmacists I operated on a shopping budget and I get to spend but not feel bad about it.

Good to hear from you darling!

yes, seriously, out of sight out of mind. i stopped all those groupons and such that were “offering a deal.” i cannot remember the last time i really went shopping. i only buy stuff online that i need.

Yes Catherine! I had to get all of that junk out of my inbox. It was killing me!

That picture is killing me. We have similar ones in my family but five kids! I feel for the photographer of my old ones. Getting four people to smile and look at the camera is more difficult than it seems!

I use “four letter words” and I’m not proud of this. As for movies that have affected me, I think “Edward Scissorhands” made me want to be a photographer. So that’s powerful! And “Eternal Sunshine of the Spotless Mind” made me want to be a writer. So many thoughts in both.

I’m budget friendly. I don’t use coupons very often, though.

Tamara recently posted…Baby Hold On: Truro, Part 1.

I didn’t even think of the photographer’s woes in family portraits! I always just think family portraits are funny!

I love Edward Scissorhands! Classic!!!

What a great post Joi! I am not great with budgeting specifically but I do have a general sense of how much to spend/save every month. I’m still hoping to make my millions from a great idea! Lol!

FitBritt@MyOwnBalance recently posted…National Yoga Month

I hear ya Brittany! Shark Tank fan??? I’m sooo intrigued by that show and my own “big idea”!

Need to check out this book. I am not big on coupons they never have the coupon I need when I need it and when I do need it, its expired. I give my 7 year old 5 bucks every Friday. If I have to talk to him more than 3 times a day I take away one dollar. He better not hustle me cause I am broke hustle his dad which is equally just as broke lol

Kita recently posted…Pinteresting Wednesday

I love it Kita. Their actions should determine the amount. I don’t recall that happening to me…good practice!

I love money management – in my 20’s I was in banking and i learned some great things. So reading about money is a little passion of mine. I love to teach my kids too. All vacation, my 15 year old and I were talking about investing and discussing some of the money books I had suggested to him to read and he started (ones that are more geared to Canadians ). I’ll have to check out this book though – I’m sure many of the main money strategies apply to us Canadians too!

Leah Davidson recently posted…Back to School

I love to hear stuff like this! I also was thrilled to read how you were handling all the kids with the cards last week while vacationing! I too love reading about money! We have that in common dear!

Awww…look at that adorable picture! The husband and I theoretically have a financial planner, and he seems to think we’re better off than I do. Also agree on the coupon statement…that and buying big box store sizes of things you can’t possibly use before they go bad. I’m definitely going to have to take a look at this book…as soon as I’m finished with the parenting/discipline book I started reading a few month’s ago!

Leslie recently posted…{Weigh In Wednesday} Week 35

Lol, a few months ago Leslie! I fly through books but I know several people who take their time reading. Busy as bee as usual my dear! I imagine with kids, I’ll have to slow down on reading.

Coupons are my nemesis! Either I cut them out, save them until they have expired then throw them out OR I use them to justify spending more than I would without a coupon. You’d think that being an accountant I would know better….

Mo at Mocadeaux recently posted…Are Cookbooks Obsolete?

LOL, Mo! The accountant thing works for and against you, huh!

I am enticed by coupons only when they are for something I need. So most of the time I don’t use them! I am working on the budget thing…it is not one of my strong skills.

Michelle recently posted…Parenting in a Foreign Land

Well as organized as you are with photos, I’m sure you can transfer that over to disciplined budgeting. I need YOUR photo organization patience!

Unfortunately I was taught NADA about finances growing up. Imagine my surprise when I got to college and some crazy company gave ME, an unemployed 18yo a credit card!!! Little did I know, that was the beginning of my financial ruin – before I had even gotten started good. It took some years for common sense to kick in. Today I have the budget of all budgets, complete with an Excel spreadsheet tracking every bill to be paid and dime spent from now to eternity. Financial responsibility is so important, especially with the unpredictibility of the current job market. Thanks for posting this!

Kennie recently posted…The Lure of Eve’s Bayou

Kennie, that story is SOOOO common! I am so glad that you got past that! That is totally worth sharing with others! Amen to financial responsibility!

I really really do try to budget. I like to shop when there are good sales. I don’t like to use four letter words, however, I do believe I have used them a few times in my life. I love the movie ” A Time to Kill” it shows how much love a father has for his daughter. That kind of love is priceless.

I love the family picture . I absolutely love looking at my babies when they were small. They bring back such sweet memories.

That was a VERY good movie Mother! Nothing like a Father’s love for his daughter…well..there’s the Mother’s Love 🙂 !!!!

I LOVE the photo as well! You all are the best parents!!!!

Thanks to my “plan B” fund, I have financially survived my year after the dreaded D. This is such great advice, Joi. Remarkably great advice. And I love how you have taken a role with sharing financial health with others.

Ilene recently posted…Jersey Girls Don’t Pump Gas

Thanks Ilene! I have been following along with you for a few months and I am very happy that you are surviving and doing well with your new move. I’m looking forward to you getting settled and back to your regular blog schedule.

First – love the picture! Next – love the coupon statement. Funny but very realistic. I once came home with a dress. My husband said, “are you really going to wear that?” I said, “I don’t know but it was only $10!” His reply, “That’s $10 we could still have.” Small beans, I know. But I never wore that dress, I ended up donating it and still hear his voice when I’m considering buying something just because it’s on sale. I bought Rich Dad Poor Dad and never read it, you’ve inspired me to find it, I’ll bet there’s something in there I could use!

Stephanie recently posted…Three Simple Steps for Better Pictures at the Beach

Stephanie! Good to see you here lady! Please don’t let that book collect dust any longer! It is an excellent read….seriously changed my entire thought process or should I say solidified some thoughts and enhanced others! Thanks for visiting.

I’ve done the $10 dress thing before and had to give it away. Happens to us shopaholics!

I made the mistake of being proud when I divorced and insisting I could pay half of my children’s expenses when my ex made twice as much money. It nearly bankrupted me. I was able to eventually dig my way back out. A budget or some sort of spending plan is crucial for long term survival in my opinion.

LydiaF recently posted…Breakfast Cookies #1 {Real Food Fridays #4}

Yes ma’am Lydia! I’m glad you survived that! THanks for sharing!

Very interesting! I love Robert Kiyosaki’s book. Modern technology makes it easier for us to spend. From grocery store coupons which we can download directly onto their store savings card accounts to apps that help us find even more bargains. I am the one who use to be the victim of coupons. I feels like it’s a waste to not use coupons. I’m literally confuse with couponing and necessity. But I’ve learnt that good couponing is not a bargain but buying something because it’s a good value. Sort out the coupons to match your grocery list and pass along to friends the coupons you’ll not use. That’s a good way to make the most of your coupons.

P’s: You looks so much like your father. Glad you posted the picture.

Honeybee recently posted…What to Do When Life Doesn’t Seem to Be Working for You

Thanks Honeybee!

You have made a very powerful comment! I hope people take heed to your advice.

I don’t do much grocery shopping, mine was more or less clothing and accessory shopping 🙂 I feel you though! Great advice my friend!!!

I NEED a book like this in my life! Sounds like it covers a pretty wide range of scenarios and topics which is always good.

Kate recently posted…How being an expat has changed me

Very much so Kate! Give it a shot!

We made some common financial mistakes when we were first married and it took a long time to get over them. Now we do much better with budgeting and sticking with it. Coupons? Not so much because they are often for foods we don’t eat.

Diane Fit to the Finish recently posted…Sweet, Sweeter, Sweetest: Changes in Taste Perceptions

Good deal Diane! A few trials and tribulations can be great learning tools. The author of this book has an awesome history and that’s one of the reasons I love her book. She bounced back most excellently!

{Melinda} I certainly could use some help in the budget department. I don’t go out on shopping sprees, but my husband and I don’t seem to plan ahead very well. And that can be devastating when two or three things hit at once. Aaaaa!!

Mothering From Scratch recently posted…walking in our shoes: our role in shaping children

Yes ma’am, so true! I am a planner and it still aggravates me when multiple things hit.

Honestly this wedding has me ALL OFF my budget but I plan to get back to it afterwards… Usually I’m like pay everything save something and play with the rest. However I have a few things in mind that are going to need me to play a little less…. My baby gets 5 bucks a week IF and only IF she does her chores, but she is only 8 and enjoys using her money at banking day at school. They have the banks come and they can deposit money into a savings account. That is the only reason it is so cheap Im sure!

Toya recently posted…Wedding… Another list!!!! lol

Oh that is an awesome school program! We should have had something similar back in the day!

I am stopping by from SITS & I’m so happy I found your blog! Over the last couple of months I’ve started a budget & it’s amazing how smooth things have gone. Now I’m hooked! I’m trying to get myself out of credit card debt too. With this budget I’ve reduced it by 65%! I’m a new follower through BlogLovin.

Leslie recently posted…What Else To Do With Christmas Lights

WONDERFUL Leslie! I hope you are sharing your success. I must check out your blog. Thanks for visiting SITStah! Please come again soon.

Joi

I love that picture of your family. Your mom was stylin’ even then! I love financial talk, and there’s the saying “Budgets are sexy”. However, I am the worst about spending money when I should save it. I justify it by thinking “well I never pay too much for anything.” Well, when you put all the little things together, it’s a BIG chunk, right?? 😉 Lately, I’ve gotten serious though. I want to be a good steward of my finances, and show the Lord I am trustworthy of blessing me with more – that I won’t spend it all on all the wrong things. Yes, I tithe and give, but I am striving to be accountable with my budget.

Good post.

XOXO,

Meredith

Meredith recently posted…The Heirloom Room Gets A Bench